is car loan interest tax deductible 2019

A new section 80EEB was introduced. You can use your actual expenses which include parking fees and tolls vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine maintenance and.

Car Loans For Teens What You Need To Know Credit Karma

In the year in which the interest pays eg for a single recipient the interest may.

. It allows deduction on the interest paid on the loan for the purchase of an electric vehicle. Vehicle loans interest expenses You can deduct interest on money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or zero-emission passenger vehicle you use to earn business income. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status.

Interest in a loan could be deductible if the interest was legally required to be paid. Include this interest as an expense when you calculate your allowable motor vehicle expenses. If you use your car for business purposes you may be able to deduct actual vehicle expenses.

Depending on whether income reporting reports are filed eg by one individual. Is Car Loan Interest Tax Deductible. Used 2019 Kia Sportage SX Turbo for sale in Joplin MO So if you use your car for work 70 of the time you can write off 70 of your vehicle interest.

The tax deduction is only available for the interest component of the loan and not for the principal amount. Is Car Loan Interest Tax Deductible. How does tax benefit on Car.

The standard mileage rate already factors in costs like gas taxes and insurance. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Credit card and installment interest incurred for personal expenses.

Interest paid on a loan to purchase a car for personal use. The tax code classifies the interest you pay on credit cards as personal interest a category that hasnt been deductible since the 1980s. For this the lender must have rights to enforcing payment of principal and interest.

You cant even deduct depreciation from your business car because thats also factored in. However you may be able to claim interest youve paid when you file your taxes if you take out a loan. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

For example if you pay 2000 in tax-deductible student loan interest this means your taxable income will be reduced by 2000 for the year in. So your total taxable profit for the year will be rs 476 lakh after deducting the interest that you paid towards repaying the car loan. Depending on whether a married couple is filing their taxes separately up to 375000.

Youre allowed to take a tax deduction for some types of interest payments but unfortunately credit card interest is not among them. Deducting Your Actual Expenses. Can I deduct car loan interest deductions.

Experts agree that auto loan interest charges arent inherently deductible. What Interest Is Tax Deductible In 2019. Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate.

June 7 2019 301 PM. June 6 2019 1046 AM You cannot deduct a personal car loan or its interest. If youre an employee vehicle expenses of any kind are not deductible even if you use your personal vehicle for business purposes due to the Tax Cuts and Jobs Act of 2017.

While typically deducting car loan interest is not allowed there is one exception to this rule. Types of interest not deductible include personal interest such as. Single filers and those who are married and filing jointly can deduct up to 750000 this tax year.

However HMRC is a little more generous with business vehicles. In order to promote and motivate individuals to buy electric vehicles the Government of India in Budget 2019 announced to provide a deduction for the purchase of an electric vehicle. It includes both required and voluntarily pre-paid interest payments.

Cash roprietorial method ie. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use. 750000 is the limit for mortgage interest deductions as of 2019.

But there is one exception to this rule. If you need a vehicle for work and youve bought it on a business car loan interest payments can be a major outlay. Interest paid on a loan to purchase a car for personal use.

In order to do this your vehicle needs to fit into one of these IRS categories. If the cars just for personal use you wont be able to claim this money against tax. Self-employed taxpayers may deduct car loan interest provided they deduct only that portion related to business use of the vehicle.

Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as interest to purchase or carry tax-exempt. 1 Best answer. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year.

Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. However if you are buying a car for commercial use you can show the interest paid in a year as an expense and reduce your taxable income. You have two options for deducting car and truck expenses.

Car loan interest is tax deductible for commercial loans When you take out car finance to purchase a vehicle for use in your business the interest you pay on the loan is a business expense. The student loan interest tax deduction can be tricky to calculate so we created this calculator to help current and former students estimate the value of their student loan interest deductions along with their average tax rate tax bracket marginal tax rate for the current tax year. 2019 Student Loan Interest Tax Rate Calculator.

Investment interest Qualified mortgage interest. Answer Typically deducting car loan interest is not allowed. Briefly speaking the maximum loan amount was 50000.

Interest paid on personal loans car loans and credit cards is generally not tax deductible. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Deductions for mortgage interest are limited for 2019 to 750000 meaning the interest you pay can be deducted from your mortgage debt up to 750000.

This means that you can claim a tax deduction based on the proportion that business use makes up the total use of the vehicle.

Is Car Loan Eligible For Tax Exemption Paysense Blog

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

Purchasing A Car For The Business Has Many Tax Advantages Vip Autos Hemet Ca

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Expenses What You Can And Cannot Claim As Tax Deductions

Save Income Tax On Car Loan By Opting For Ev Here S How

Solved Where To Enter Car Loan Interest

Truck Driver Expense Spreadsheet Laobing Kaisuo Truck Driver Spreadsheet Drivers

Buying A New Car Tax Implications Dpm Financial Services

Is Buying A Car Tax Deductible In 2022

What Is The Average Car Loan Interest Rate In Canada Loans Canada

Car Loan Tax Benefits And How To Claim It Icici Bank

What Is A Balloon Payment Car Loan Positive Lending Solutions

Is Car Loan Interest Tax Deductible In The Uk

Is Buying A Car Tax Deductible Lendingtree

Is Zero Percent Car Loans Really A Good Deal Or Is It A Dealership Trick Quora

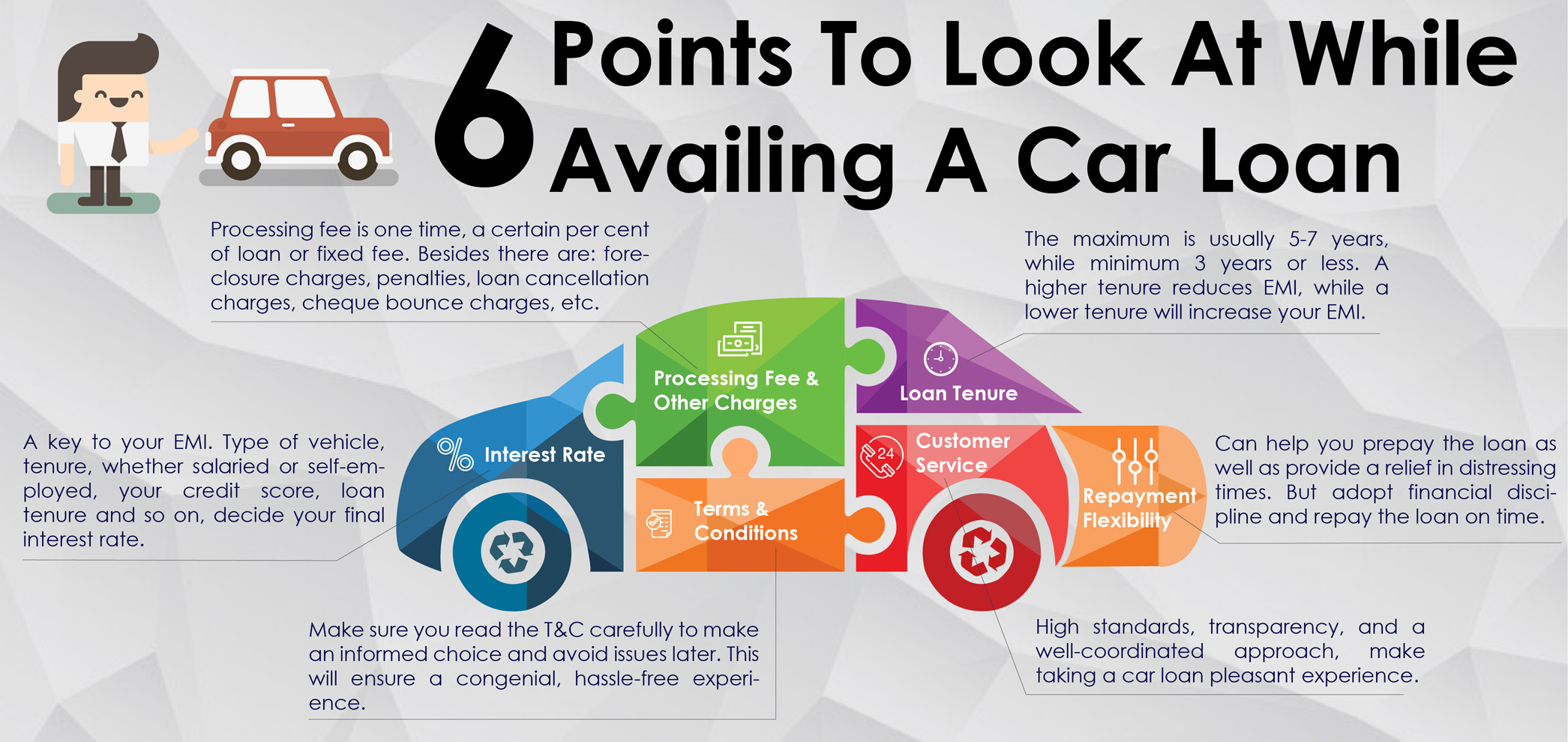

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

Auto Loans And Car Loan Financing New Used Becu

Pin On Credit Union Marketing Services Ideas Marketing Strategy