idaho military retirement taxes

Military retirement pay is partially taxed in. How We Determined the Best Places to Retire in Idaho.

Idaho Military And Veterans Benefits The Official Army Benefits Website

Up to 3500 is exempt.

. Idaho Retired Military Pay Income Tax Deduction. When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax. Ad What Are Your Priorities.

Free Easy Tax Filing For Active Military. Kentucky - Up to 31110 is tax-free you may be able to exclude more in some situations. Idaho H484 2022.

Taxes military retirement age. Form 39NR Idaho Supplemental Schedule for Form 43 Nonresident and. Military pay is tax free if stationed out-of-state.

Form 43 Idaho Part-Year Resident Nonresident Income Tax Return. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why you might consider them the best tax-friendly states for military retirees. Civil Service Idahos firemens retirement fund or Policemans retirement compute the allowable deduction on ID Form 39R.

Tax Experts Explain Federal and State Tax Breaks for Retired Military Members. Idaho residents stationed outside of Idaho Active duty military income earned outside of. Taxpayer is 65 years old or older or.

War with a service-connected disability rating of 10 or. Military or the un-remarried Surviving Spouse of such member. Social Security retirement benefits are not taxed at the state level in Idaho.

Veteran of a US. See How Easy It Really Is When You File Today. Idaho doesnt charge its state income tax on military retirement pay for those age 65 or older but it does tax pension benefits for military retirees who are younger than 65.

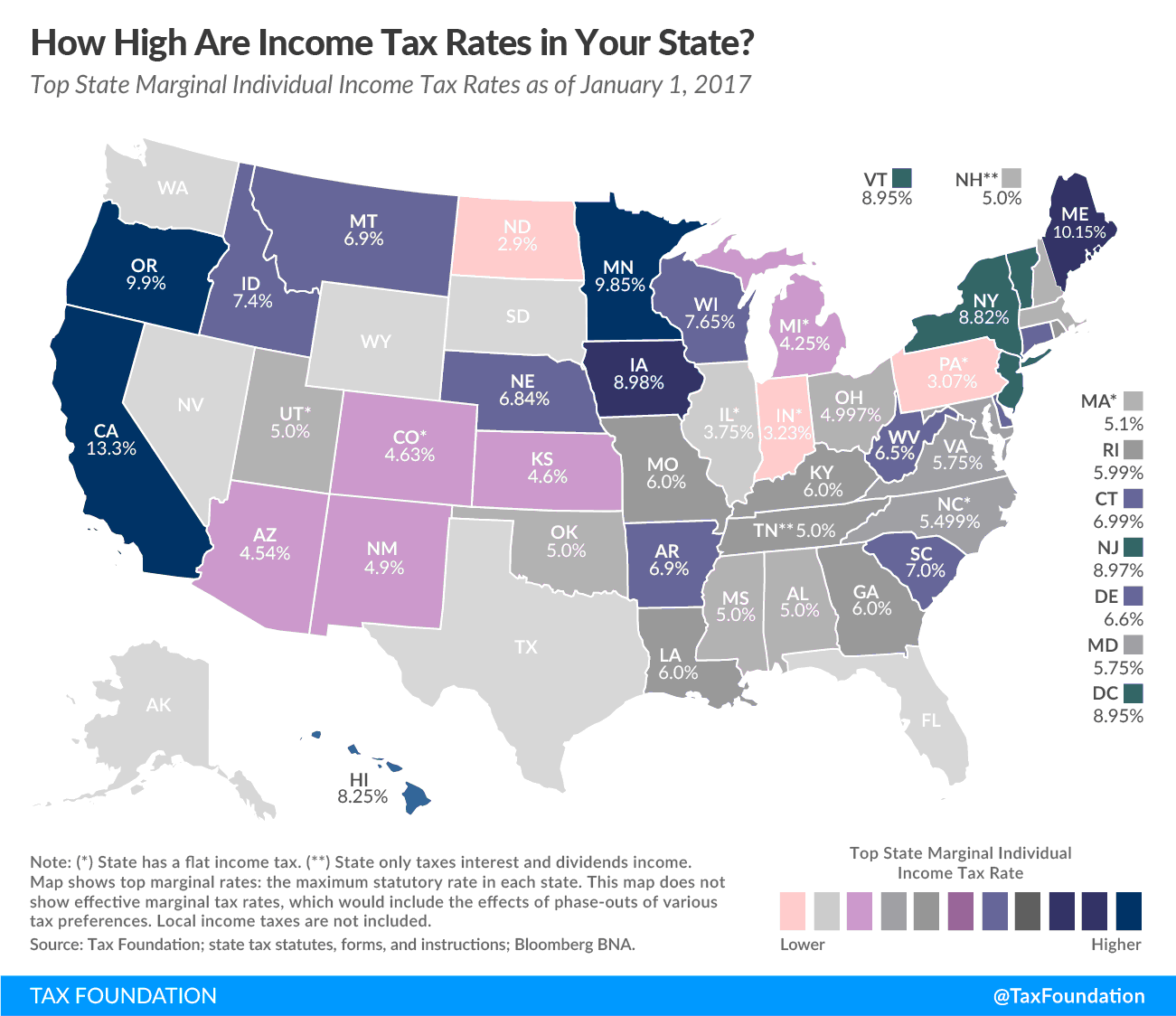

Taxpayer is 62 years old or older and. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Pennsylvania and New Jersey which border.

Ad What Are Your Priorities. We now offer consulting services. With Merrill Explore 7 Priorities That May Matter Most To You.

Ad 100 Free Military Tax Returns For Federal And States Online Taxes For Active Military. Retirement benefits paid by the United States to a retired member of the US. Exemptions exist for some federal state and local pensions as well as.

Additionally the states property and sales taxes are relatively low. The first 5000 of military retirement income is tax-free and that amount increases to 15000 when you turn 55. Idaho H484 2022.

Overview of Idaho Retirement Tax Friendliness. Ad Know More About the Many Tax Breaks That Military Veterans Have Available To Them. With Merrill Explore 7 Priorities That May Matter Most To You.

Military retirees in Delaware under age 60 can exempt up to 2000 from state tax increasing to 12500 for retirees older than 60. To determine the best places to retire in Idaho we weighed a number of different factors crucial to retirement. Part 1 Age Disability and Filing.

Summary Actions 2 Sponsor. The military income earned by an Idaho resident stationed in Idaho is subject to Idaho income tax. Idaho Veteran Financial Benefits.

Idaho Military and Veterans Benefits. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. State Income Tax Retired Military Pay Benefit Deduction A veteran or.

Idaho - Tax-free for retirees 65 and older or disabled retirees 62 or older. If you receive retirement income from the Military US. Idaho H484 2022.

While potentially taxable on your federal return these arent taxable in Idaho. Those over age 65 or who are totally disabled or who.

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Retirement Locations Best Retirement Cities South Dakota

1031 Exchange Rules Success Stories For Real Estate Investors 2021 Real Estate Terms Real Estate Investor Real Estate

Early Retirement Blogs For Everyone Early Retirement Financial Independence Retire Early Retirement

States That Don T Tax Military Retirement Pay Discover Here

These States Don T Tax Military Retirement Pay

States That Don T Tax Military Retirement Pay Discover Here

20 Awesome Investing Quotes To Remember Investment Quotes Investing Finance Investing

Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota West Virginia

Idaho Military And Veterans Benefits The Official Army Benefits Website

Idaho Military And Veterans Benefits The Official Army Benefits Website

State By State Guide To Taxes On Retirees Tax Retirement Retirement Income

5 Facts About Retiring In Alaska Retirement Facts Alaska

9 Of The Best Freedom Loving Quotes From Our Founding Fathers Chicks On The Right American Flags Flying American Flag Overseas Travel

List Military Retirement Income Tax

Reasons Why Having Good Credit Is Important For Modern Living Money Life Hacks National Insurance Good Credit

The 10 Best And Worst States To Retire In 2017 Clark Howard Clark Howard Retirement Bankrate Com